I’ve always been a little squirrelly when it comes to money. Even as a kid, I would stash away money and refuse to spend it for months–sometimes even years–at a time. By middle school, I had a reputation in my family for always having more cash on hand than anyone else. If my parents needed to bum a 20…well, Scrooge had nothing on me. I could have lent it to them, but I wouldn’t have. On principle.

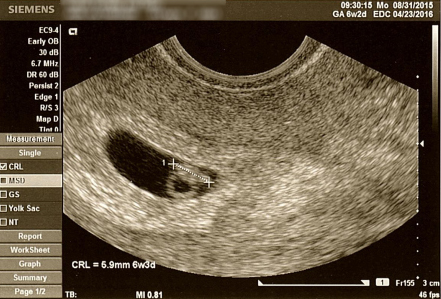

I don’t know if my miserly streak is the result of growing up in a house where money was a constant source of tension or just my personality. Regardless, money is something that I always worry about (like the occasional panic attack worry), even when times are good. Now that we’re expecting a baby…my worries have kicked into overdrive.

It’s expensive becoming a parent. Straight out of the gate, your new baby comes with a massive hospital bill that even “good” insurance can’t fully mitigate the damage from. Then you have to add baby to your health insurance, and your premiums go through the roof. You’ve got the hundreds of dollars worth of new baby supplies you’ve had to purchase. Day care is on the horizon, and if you’re like us, that means you’ve opened an FSA that garnishes an obscene amount of money from your wages every month. For us, the baby is also going to show up right in the middle of tax season, and given our income and lack of tax-deductible items, I don’t even want to think about how much we’re going to have to pay in. (All of you people who are excited for tax season because of your refund check? I hate you.)

And then on top of all this, there is the fact that I’m not going to be drawing my usual paycheck. I’ll be getting 60% of my paycheck for the first 6 weeks I’m out. After that, it’s crickets until I’m back to work. All of my bills, of course, are the same, and Kellen and I still have to eat (even if baby gets free lunch from here until 6 months.)

To say that I’ve been a little panicky about our finances is a massive understatement. I’ve been doing all I can to prepare for the fact that basically for the first 3 months of our child’s life, I’ll be bringing in less than 1/3 of my usual income. For example:

- Chucking $500/month in savings for the last few months specifically earmarked for maternity leave expenses

- Freezer meals to save on food expenses

- Meal planning to save on food expenses

- Planning to cloth diaper to keep from having a diaper bill

- Planning to breastfeed to keep from having a formula bill

- Paying down debt so we don’t have to worry as much about credit card bills

Logically, I know that we’ll have enough to get by, especially considering that Kellen will still be drawing his full paycheck and probably also getting a performance bonus in the next couple of months. (Thank god he works for a good company.) Still…the idea of opening my bank account to see no money coming in and all the same amount of money going out–and then some–makes me feel kind of sick.

Kellen and I were discussing it last night, and we realized the last time I wasn’t receiving a steady paycheck, I was 19 years old, and that was because the summer before I had earned enough money to pay all of my expenses for the school year and didn’t need to work. And even then, I was a full-time student, so it’s not exactly as if I was sitting around on my couch for a year. (If you’ve ever wondered what a workaholic looks like…) In other words, it’s been 8 years since the last time I was without a paycheck.

I don’t even know how to process a world where I’m not working, where I’m not making money, and where I’m relying entirely upon someone else for my financial security…even if the person I’m relying on is my husband, and I know that he’s doing just fine. It’s just so foreign.

So every time I think about it, my stomach does flips, my heart starts to race, and my arm pits get all prickly and moist. (Ew.) Even if I know, logically, we’ve got more than enough, we’ve prepared ourselves very well, and everything is going to be fine. When it comes to money, there’s always, even in the best of times, some terrified, anxious creature cowering somewhere inside of me with their “The End is Nigh” cardboard sign at the ready. New baby expenses and maternity leave (and possibly also pregnancy hormones) are turning that creature into a shrieking nightmare with not only a sign, but a bullhorn and a whole cult of followers all shouting out me to run, run, before it’s too late.

*sigh*

I’m looking forward to 3 months of bonding with my new baby, and I know that emotionally (if not for baby, then certainly for me), it’s for the best that I don’t attempt to go back to work after 6 weeks. BUT. It’s times like this I really wish we lived in Canada.

I’m preparing for the arrival of baby #2 in March and beginning to freak out a little about the finances! I work part-time right now; my 2.5 year old goes to preschool 2 days per week. I’m worried about adjusting our budget to me not working at all! Not to mention hospital bills, doula, insurance…